Given the political nature of elections and the economic consequences of policies implemented by elected officials, it is not surprising that many believe U.S. presidential elections have a significant impact on the behavior of financial markets. Our ambition for this BYCIG insight is to explore and understand the historical relation between presidential elections and stock market performance, considering both immediate and long-term effects. We will examine patterns that have emerged over time, as well as the underlying economic theories that may explain these patterns.

Election Cycle and Economic Cycle – Is there a correlation?

One of the most widely discussed theories about the link between presidential elections and stock market performance is the “Presidential Election Cycle Theory.” The late Yale Hirsch, founder of the Stock Trader’s Alamanac pioneered this theory. The theory argues that stock markets tend to follow a predictable pattern that aligns with the political calendar. According to this theory, stock market performance can be broken down into four distinct periods corresponding to the four years of a presidential term. I will provide the year in the cycle and then the calendar year in our current election cycle in parentheses:

- The First Year (Jan. 2025 – Jan. 2026) : Typically, the first year of a new presidential administration sees slower economic growth as the president sets the agenda and works through policy changes. Markets may experience volatility as investors assess the new administration’s priorities and policies. Once the president is in office they are now expected by the market to implement the policies that they were elected on. Often times the implementation is difficult and cannot be effectively conducted within a one-year timeframe. This often leads to a simmering disappointment in the markets.

- The Midterm Election Year (Jan. 2026 – Jan. 2027): Historically, midterm years have often been marked by a decline in stock market performance. The fear of political gridlock, concerns about the effectiveness of the president’s policies, and the uncertainty surrounding the upcoming midterm elections can lead to cautious investor sentiment. This year is oftentimes the least predictable. It is important to not discount non-political market moving events, and during this year, the market is least focused on politics. This means that your inbox should be filled with earnings releases and M&A notifications, not executive policies in 2026.

- Pre-election Year (Jan. 2027 – Jan. 2028): The third year is often viewed as a “sweet spot” for the stock market. With midterm elections out of the way, the incumbent president’s party typically works to stimulate the economy with policies that boost growth. Stock markets often see strong performance during this period as the government tends to focus on re-election and positive economic outcomes. This effect is often minimized when a sitting president is not up for reelection. The two drivers of growth in this period are presidents wanting to improve their economic record for reelection and improving their legacy. The former is not as much of a motivator for second term presidents, but they still often work to improve their record for the sake of their party.

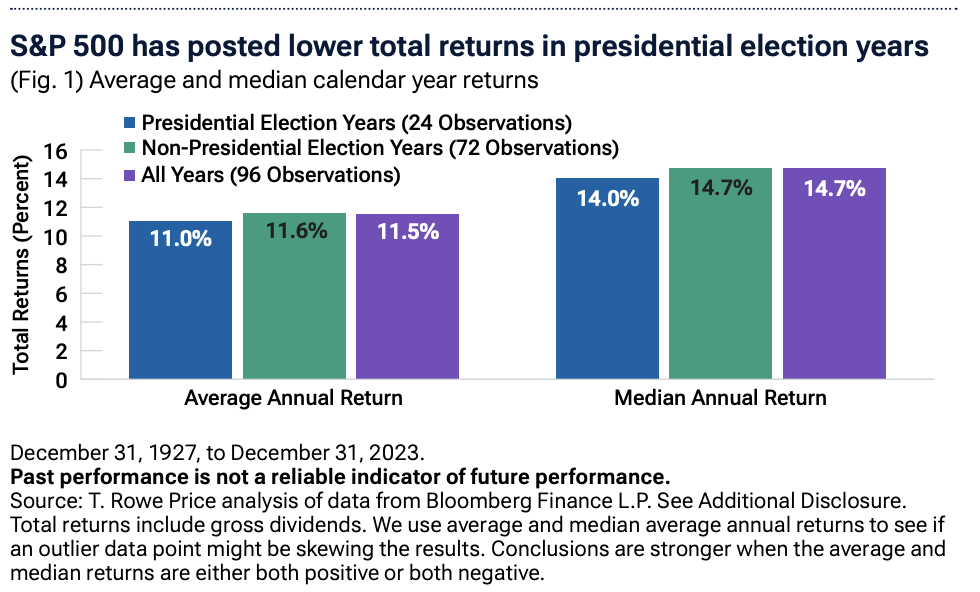

- Election Year (Jan. 2028 – Jan. 2029): The election year is often characterized by increased market volatility, as investors anticipate the outcome of the election. Uncertainty about the future direction of policies—especially in a highly polarized election—can lead to market fluctuations, though the overall trend can still be positive if the economy is strong.

While this cyclical pattern provides an interesting framework, it is important to note that the theory is not always precise. There are years where the pattern deviates, and the market’s performance can be influenced by a wide range of factors beyond the political cycle, including global economic conditions, corporate earnings, and financial crises.

The inherent irony in this cycle is that it seems like the market continues to fool itself. Anticipation of president’s leads to upward skewed volatility, disappointment in executive lethargy causes ursine downwards movement, and then the cycle begins all over again.

Some Historical Examples – Examining the data for this theory.

When examining historical trends, it is hard to deny that there is somewhat of a correlation between cycle year and market performance, and yet it is far from a deterministic relationship. To illustrate this, our team at the BYCIG examined some key historical periods that exhibit this relationship well:

- The 1990s (Clinton Administration): The 1990s were marked by strong economic growth, low inflation, and a surging stock market. Under President Bill Clinton, who was re-elected in 1996, the stock market saw substantial gains. This period is a good example of the “third year” in the Presidential Election Cycle Theory, as the U.S. economy experienced sustained growth during his second term, spurred by technology innovation and global market expansion. The market grew nearly 35% in 1995, the third-year of Clinton’s first administration. It then grew 25% in 1999, the third term of his second administration.

- The 2000 Election (Bush v. Gore): The election of George W. Bush in 2000 took place during a period of economic uncertainty. The dot-com bubble had burst, and the country was on the brink of a recession. The subsequent market downturn was exacerbated by the contested election and the uncertainty that it generated. In Bush’s third term of his first administration, the year 2003, the market surged 25% after two years of prior bearish behavior. In his third-year for his second administration the market grew a moderate 6%. However, in the years following, the market was hit again by the 2007-2008 financial crisis, which had profound effects on stock market performance regardless of the election cycle.

- The 2008 Financial Crisis (Obama Administration): The stock market crash of 2008, which coincided with Barack Obama’s election victory, provides an example of how external factors can have a stronger influence on the market than the election itself. In Obama’s first term, the market slowly recovered from the crisis, but stock prices remained volatile for much of his first year in office. Over time, however, the economy stabilized, and the stock market entered a long recovery period during his second term, although election year volatility remained a concern. In his third-year in 2011 for his first term the market produced a small gain of 6% which relative to prior years of catastrophe some might take to be a great achievement.

- The 2016 Election (Trump v. Clinton): The 2016 election cycle was a particularly volatile period for financial markets, as investors faced uncertainty surrounding the outcome of a contentious election. In the months leading up to the election, the stock market showed nervousness due to fears of a potential policy shift under Donald Trump. However, after Trump’s victory, markets surged, particularly due to anticipated corporate tax cuts and deregulation. This exemplifies the market’s ability to react not just to election outcomes, but to anticipated policy changes that affect economic fundamentals. In Trump’s third year of his first term the market gained 22%.

- The 2020 Election (Trump v. Biden): The COVID-19 pandemic had a dramatic impact on stock markets in 2020, overshadowing the presidential election itself. The market crashed in March 2020, but recovered as governments around the world rolled out fiscal stimulus measures. When Joe Biden won the 2020 election, markets reacted positively, buoyed by the expectation of additional stimulus and pandemic relief. Again, external factors like the global health crisis dominated the market’s trajectory, illustrating how unpredictable external shocks can influence market movements, irrespective of the election cycle. In 2023, Biden’s third year in office, the DJIA gained 23%.

What is the market moving on?

The impact of presidential elections on the stock market is not solely determined by the political cycle. There are a variety of political measures and actions that can have market ramifications:

Economic Policies: The policies proposed by presidential candidates, particularly in terms of taxation, regulation, and government spending, can affect investor expectations. For instance, a candidate promising tax cuts or regulatory relief is often seen as favorable for markets, while proposals for higher taxes or increased regulation can lead to investor uncertainty. The markets are unsure about the policy that will come out of the Trump administration. They believe that taxation policy is more than likely to relax, energy regulation, and specifically fracking will be less aggressively restricted. Another important element of a presidential election, something that the news have made very clear over the past week, is the appointment of cabinet members. Trump nominated Robert F. Kennedy Jr. for secretary of health and human services. RFK Jr., in his running for president, ran into one large problem with his past; he had often proclaimed to hold an anti-vaccine position during the COVID-19 crisis. With his appointment the healthcare industry took a hit. The S&P 500 Pharmaceuticals index fell about 2% on the day of his appointment, Moderna (MRNA) fell 7%, Pfizer slid 4.5%, and PepsiCo took a tumble as well.

Global Geopolitical and Macroeconomic Actions : Geopolitical tensions, trade wars, pandemics, and other global events can overshadow domestic elections. For example, the COVID-19 pandemic and the subsequent economic shutdowns had a far more immediate and significant impact on the markets than any U.S. presidential election.

The most notable example of an action that has already been priced in to have considerable market influence is the “Trump tariff” which could be up to a 60% tariff on goods coming in from China, and up to 10% from all other countries. This tariff has been researched by various think tanks and universities and the consensus is that this would be detrimental to the consumer and would require corporations to markup their goods. You can see that this floated tariff is already having an impact on mid and small cap consumer oriented companies that import lots of goods like LVMH and other clothing brands.

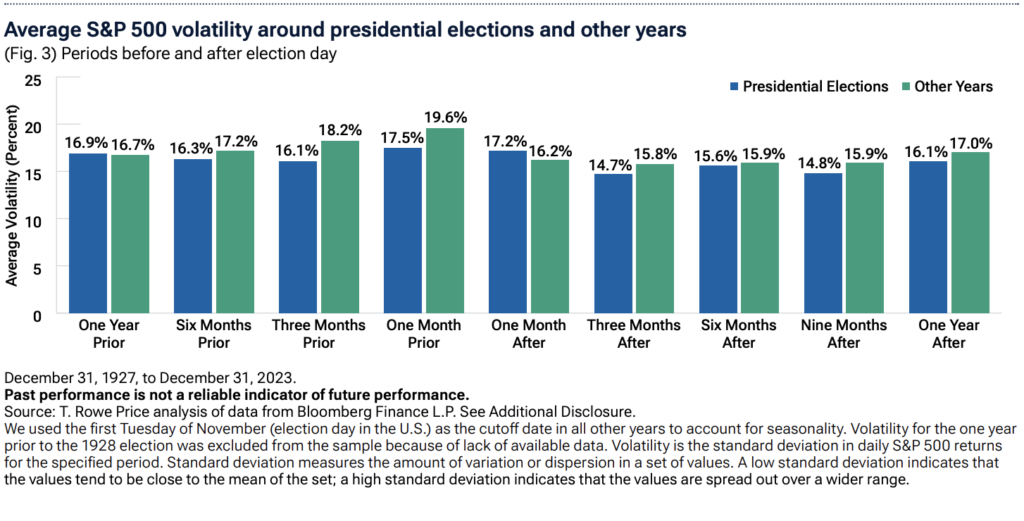

Market Sentiment and Investor Psychology: Elections can create periods of uncertainty, which often lead to market volatility. The anticipation of election outcomes—especially in contentious or divisive races—can create an environment where investors adjust their portfolios based on risk aversion or optimism, regardless of the actual election results.

There is perhaps more truth to this element of market reactions to elections than any of the other components and mechanisms. Markets become increasingly volatile coming towards the election day, especially in the instance of the 2024 election. We were seeing implied volatility that was highly unusual approaching election day despite the fact that essentially no one had any idea who was going to win. Simply put, the data shows that investors are frantic and excited prior to elections and once an election result is given they cool down. This cooling is a good thing for most people in the market. It means that markets will return to a more predictable and normative stature and investors are now breathing a sigh of relief seeing that they know who the president is and they can make an educated guess on how he is going to impact the general US economy. Now the market will likely take time to price in these pain points and benefits to various corporations in the US.

Reminder – Be Wary

It should be a relief for all investors and investment management institutions that the elections have come to a close. Regardless of the winner we know who the president will be and we know that there is no existential threat to the government of our nation. In this moment it is important to think about the decisions you make. Many investors rushed into the oil sector following the first election of Donald Trump and this turned out to have been a better strategy under Joe Biden than it would have been for a Trump ‘16-’20 administration. Likewise, a lot of the gains that we see across the financial instruments spectrum are likely going to settle. Excitement in the crypto industry will soon quell once crypto investors realize that there is no guarantee that Trump will lead to a gain in crypto value. This will lead to massive dips in the price of assets like Bitcoin which are currently peaking at around $90,000. Be prepared to see drops in some of the companies that surged on a Trump election victory. As the Presidential Election Cycle Theory tells us — there is going to be hype and there is going to be lucidity that follows. The best course of action is to close positions during the hype and open them when the markets have adjusted to a reasonable level given the circumstance.

Thanks for reading the BYCIG insights and stay tuned for upcoming research and insights by the BYCIG.

This insight was written by Jasper Gould (President and Founder) and Jack Glickman (Vice President of BYCIG Fund and Founding Director).